The oil slump that began almost three years ago has seen the energy industry lose more than 224,000 American workers. In the fight for survival, oil companies had to come up with ways of getting more production with less cash.

Now, as the US industry begins a new chapter of expansion, does it need as many people as it used to?

Unlikely, say analysts, who see an industry far less labor-intensive than it was in 2014.

"The reality is that I think we created too many jobs when it was $100 a barrel. The industry at that point, it was nearly impossible to go broke," Allen Gilmer, co-founder and executive chairman of data-analytics firm Drillinginfo, told Energywire news agency.

"You're not going to get everybody back. But I'm not sure you're ever going to need everybody back."

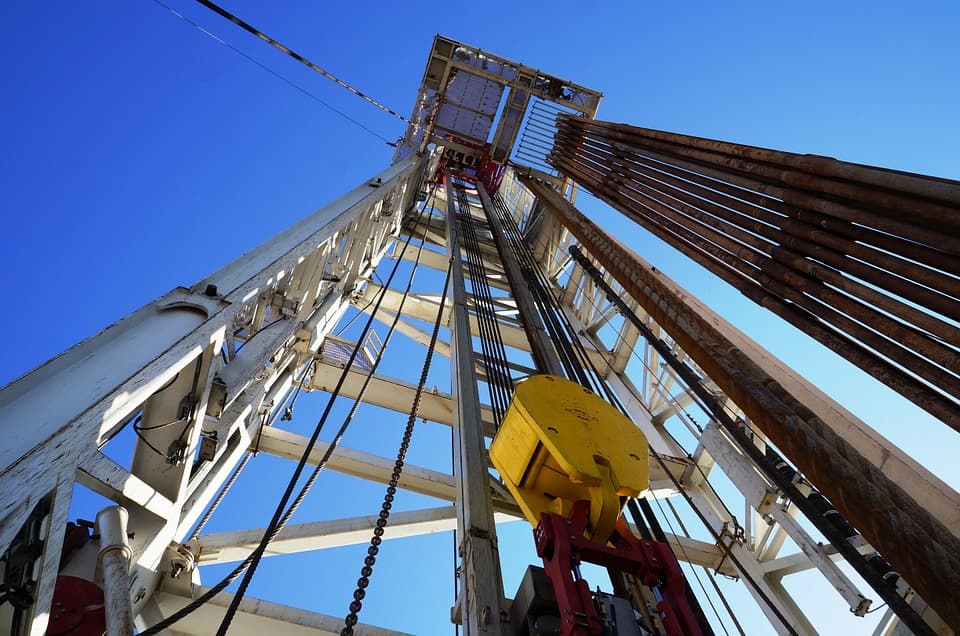

Before oil prices crashed in 2014, each new land rig spawned 356 full-time jobs in the oil and gas industry, according to Trey Cowan, senior industry analyst with Platts RigData. When prices crashed, every rig that went offline took 93 jobs with it, Cowan estimated.

Today, how many jobs will a new rig generate? The Dallas Fed thinks it will be lower than before the oil crash, telling Energywire that technology has improved and companies have pared their drilling teams down to their "A-Team."

"The extra energy industry jobs, the number of jobs that you get for every extra rig is going to be lower in this next cycle than it was in the shale boom. Because we're going to be more efficient," said a Dallas Fed executive.